Are you a veteran trader ...

Yes, I am well ...!!

If you do not follow your breeze and design a system for

your trading orders using market orders in all times of trade , they are very useful

and have the ability to cope with breakdowns interruption connect to the

Internet or computer malfunctions, you will not miss profit opportunities, and

protect you from danger.

market orders or (Orders) is an expression indicating a set

of commands that you will enter into your trading platform with the brokerage

firm.

Here we will discuss the different types of applications

that can be placed in the foreign exchange market, and you must know that the

orders differ from one brokerage firm to another, so choose what fits your trading!

So please register for a demo account and download any

trading training program suits you to carry out orders ...

Transactions orders ..

The trading platform for the brokerage firm will provide you

with all market orders to provide implementation and immediate termination of

the transactions and the program provides all types of trading orders that the

trader needs, including ..

Orders

|

What is

the function of this order?

|

Market

Order

|

Open a transaction

|

Entry

Order

|

Putting a hold transaction on waiting

|

Limit

Order

|

Putting a profitable goal for the transaction to

close it automatically

|

Stop

Order

|

Putting losses stop for the transaction to close it

automatically

|

Close

Position

|

Closing the transaction manually

|

Hedging

|

Opening two transactions , first purchasing, and

the second selling in the same time on the same currency…

|

Market

Order:

To

open transactions (buy or sell) in the currency pair at the current price

directly from influential trading prices.

Simply

go to the window screen trading prices and click by a mouse on the price of the

currency pair, whether buying or selling transaction is performed as follows:

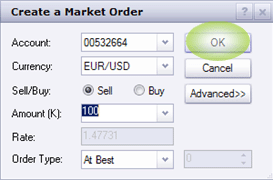

Market

Order, this opens up the deal in the immediate time during trading, and after

clicking on the price, you will see a dialogue box tells you to enter details

of a new deal for the pair, both the size of the contract Amount, and to

clarify the type of transaction, whether Buy Sell.

It

displays the choices in the implementation of the deal At Best Price itself or

canceling it if the price moves and went for another unrequired price Market Rang, and this very excellent entry

price required efficiently and not to carry out any orders on Undesirable

prices.

Note

that the price shown on the screen from time to time, and if the market moves,

the request will not be implemented

As

we mentioned just for you.

Market

Range = means the real price

*

Use this order to specify your request , select real price number in the range

by points.

Example:

If you put the number 5, the price will be implemented in light of only 5

points but more than that it will not implement the demand and this style is

favored by account managers to manage money successfully.

Entry

Order

This

means that we buy or sell at the current price, and is commonly used to

automatically open the deal if the price reaches the entrance to the command

will be executed automatically when entering and asking price.

Example:

we see euro/ dollar price 1.47000 and you think the price will go to 1.47720 to

continue its downward trend so you enter the order Entry Oder sale as a matter of hanging in

wait in the price of 1.47720 and then select the price you want, whether the

closing price with take profit or stop-loss and it performs sparkling, with the

possibility of modification at any time to these orders or deleted before they

are implemented.

How

do I close the deal /Close Position:

To

close the deal, this is a very simple, all you have to click the mouse on the

price in the box under the Close ticket deal inside the open window in the open

position and the closing of the transaction and will be as in the example

1.47758 price is the closing price.

closure

Confirmation window will appear directly to make sure you, do you really want

to close at this price!

Press

OK to close the deal by clicking it the deal closes and go to the closed

positions window.

Stop-Loss

Order

This

is very excellent, especially those who wish to manage money properly, and this

is inserted through the introduction of price limit losses if the market

reaches that price will close the deal automatically for the reduction of

losses so as not to worsen the losses too much and caused greater losses can be

adjusted these requests or canceled at any time.

*

If your order in a way that initially the market Order of the current price,

here you can enter a stop-loss price directly to the " deal ticket "

abroad under the STOP box on the open deal in the window of the open positions.

After

the introduction of the stop price , you'll find it was written on the box

trading programs under the STOP

You

can modify or change at any time.

*

But if you order in a way that initially Entry Order of the expected price to

be reached.

Price

is entered on the stop-loss trading program by clicking on the

"Advanced" and then select the stop price you want to STOP.

*

We recommend: choose touches stop loss positions with a distance of not less

than 7 points so as not to close the deal quickly because the market is

constantly moving.

Limit

Order

Introduction price of taking profit is very important for a veteran trader who does not want to overtax his temper, all he does is putting an end to take profit when the asking price and leaves his computer, and come back to see his deal after closing at the end of profit.

Introduction price of taking profit is very important for a veteran trader who does not want to overtax his temper, all he does is putting an end to take profit when the asking price and leaves his computer, and come back to see his deal after closing at the end of profit.

*

If your

order in a

way that initially the market Order of the current price, you can enter here limit order of the profit,

it works the same way as "stop-loss" but introduction under Limit box to take profit of the deal.

* If the order in a way that initially Entry Order of the expected price to

be reached.

Price is entered on the stop-loss trading program by clicking on the

"Advanced" and then select the price Take Profit Limit as you want.

Hedging

Hedging means that you open a deal to buy and

sell transactions for the same currency pair at the same time.

When

should I use the hedging?

it Is performed on transactions in the markets of long-trapped.

How do I start a Hedge deal?

For example, open the deal to buy 1 lot valued at 10,000 units in the EUR /USD

it Is performed on transactions in the markets of long-trapped.

How do I start a Hedge deal?

For example, open the deal to buy 1 lot valued at 10,000 units in the EUR /USD

Then open the deal to sell 1 lot of Euro/USD

Now

that you have two deals to buy and sell the other for the same pair as you can

see in the box "S / B"

If

the pair inclined you will have a profit in the deal and the loss of another

deal equally with "a difference Spread" and you can see the required margin

in the box Usd Mr window in the account, and since you have two transactions in

the hedging, the margin requirement is $ 1,000 just because you are in the

Hedge on the same currency pair that treated as a single transaction without

additional expense margin.

How

do I close hedging deals?

Simply

use market orders of stop losses and profit limits on each of the two deals

hedging It is better to shut down each of the two deals buying and selling

separately.

0 comments:

Post a Comment