In this

tutorial we discuss the subject of how to exploring the sizes of momentum in

the candlestick, and we use the word ("the momentum") in technical

analysis in the sense ("pushed prices sharply") may be driving prices

sharply upward at increasing the buying momentum with the increase in buyers

and called it ("bulling momentum "), or may be driving prices sharply

momentum downward with the increase of sellers and called it (" the bear

momentum ").

So that technical analyst can to explore cases of the

momentum in the charts of candlestick, so it must study the origins of the

stages of candlestick birth on chart during her different lifecycle, because

everything has an origin, and the origin is built upon the other, and each

branch comes from origin, And when we get caught up from the original we say

that it has no base. we add to this, that each building has rules and columns

and roof, if broken down rules fall down the entire construction of the roof to

the rules, because there are hundreds of forms of Japanese candles which can be

seen on the charts, We review the most important bases upon which to build

forms on the candlestick charts that help technical analyst at the end of the day

to sort out cases of price movement on the chart and the discovery of cases of

the ups downs of cases of oscillation.

The story of the birth of the

new candle:

Once you close the old candle, a new candle starts and we

call the moment of the birth of the candle ("the beginning of the balanced

candle ") and the artistic analyst can see this candle on the right hand of

the chart ("it is the last candle and it was in a movement up and

down") for this it is called on animated candles the name ("live candle

") and generally live candles do not stop of the movement, only at the end of the round trading determined by the

time frame, as we said previously.

From the perspective of experiments of our own, we can say

for sure that the origin of all forms of Japanese candles come back to ("balanced

candle ") and we call it the "mother of all candles ", because

when this candle starts, it does not have a body does not have the shades and

the Open Price is the same closing price, if it is the first moment of the

birth of any new candle.

Family tree of candlesticks:

Four Price Doji ( mother of all candles) does not stop from

birth, for example, if a technical analyst chose Frame time of 1 minute, Four

Price Doji will give birth every minute, give birth to new candle, and

therefore it is the main root of the family tree candlestick but this family

has two branches, the first branch group of individual Japanese candles, it divided

into four major factories each one produces dozens of children from forms of

individual candles Japanese single candlestick patterns, the second branch is

candles Japanese compact or composite candles set (Compact candlestick patterns

)which is about constructing firstly

three or more on each other and this hybrid resulting in the birth of a new

candle, and it is divided from composite candles two sections and they are BullishPatterns,

and BearishPatterns.

Single candlestick patterns

|

Hammers

patterns

|

Spinning

Tops patterns

|

Doji

candlestick patterns

|

Normal

candlestick patterns

|

|

Blue Hammer candlestick

|

Red Spinning Tops

|

Gravestone Doji

|

Blue Marubozu Candlestick

|

|

Hanging Man candlestick

|

Blue Spinning Tops

|

Dragonfly Doji

|

Red Marubozu candlestick

|

|

Red Hammer candlestick

|

|

Doji candlestick

|

Long Days candlestick

|

|

Shooting star

|

|

Long-legged Doji

|

Short Days candlestick

|

|

Red Inverted Hammer

|

|

Short-legged Doji

|

Yes Sen candlestick

|

|

Blue inverted Hammer

|

|

|

In Sen candlestick

|

We all know that any product produced in factories must pass

the stages of production, or what we call the cycle of production until the

product reaches its final form, the final product may be a high-quality product

may be bad, and we are in the school at night to learn Forex will not go talk

to talk too much special to all forms of Japanese products candles because

there are hundreds of forms of Japanese candles, but we will take care and God

willing, only the most important products of the most influential Japanese

candles on the future prices.

Stages of candlestick production:

First. Stage of composition of

the bulling bodies

When buyers or sellers start trading, the form ("candle

or candlesticks") is changing, and the stage of composing the candle body

that grows and thrives, depending on the type of this food this body grows , so

if the largest source of this food , coming from buyers, the body candle grows

hand up and the color of the body is blue and as long as prices are higher than

the opening price of the candle The body type ("bulling"), and the

size of the growth of this body is large or small or medium depending on the

body feeding and we mean a word ("Nutrition") in the case of a bulling

candle is blue as provided by the buyers

of the quantities of buying in the currency, the more the quantities were large

("increase momentum SPV"), the body of the candle was long and

colored in blue, and whenever quantities were ("low momentum SPV")

the body of the candle was short and colored in blue.

With the assumption that the time period for this open candle

ended and the candle closed on the image above, this candle as such, called

Blue Marubozu Candlestick and this type of candles which there is no upper

shadow or shade of substrate and express control of the bulls on the market.

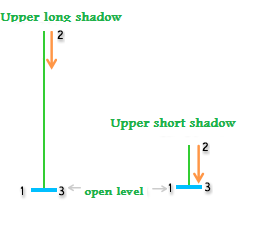

Second. Composition of the upper

stage of the shadows

Since currency trading is trading in the currency pair, if

it must be at the other side numbers of sellers trying to feed the candle body

according to their purposes in order to win the round and push prices down, in

this case, the source ("Nutrition") is provided by the sellers of amounts

of selling in the currency, and the more sellers tried to pressure on prices

downward, If they succeeded in return prices back to the level of Open Price ,

so This is the case of confirmation of the existence ("high pushing of

sale"), and here we start Note phase formation where upper shadows of the

candle that reflect the behaviors that had been carried out buyers before the

advent of sellers who were able to return prices to an equilibrium state, and,

as we note in the caption below the image, The upper shadows may be long or

short or medium according to the size of bullish momentum provided by the

buyers of sizes financial to buy the currency , long upper shadows refers to large

purchasing sizes ("High pushing of buy") .

Third. Stage of composing

bearing bodies:

Come back again to put ("Four Price Doji ") and

talking about other cases of the candle industry, for example, when buyers or

sellers start trading, the form of ("Four Price Doji ") is changing,

and begin configuration stage of candle body which grows and feeds, if the largest

source of this feed was, coming from sellers, the candle body grows hand

landing and the color of this body color is red and as long as the prices

become lower than the opening price of the candle The body type ("Bearing"),

and the size of the growth of this body is large or small or medium depending

on the body feeding and we mean a word ("Nutrition") in the case of a

candle red bearing are provided by the sellers of the quantities of sale in the

currency, the larger the quantities large ("increase momentum

Bearish") was the body of the candle long and colored red, and whenever a

few quantities ("low Bearish momentum") was the body of the candle

shorts and colored in red.

Fourth. Configuration phase

lower shadows

Since currency trading is trading in the currency pair, if

it must be at the other side numbers of buyers trying to feed the candle body

according to their purposes in order to win the round and push prices higher,

in this case, the source ("Nutrition") is provided by buyers buy in

quantities of currency, and the more buyers tried to push prices upwards, If

they succeeded in raising the price again to the level of Open Price, in This

is the case of confirmation of the existence ("High pushing of buy"),

and here we start Note forming stage appearance be shadows bottom of the candle

that reflect the behaviors that had been carried out vendors before the advent

of buyers who were able to raise prices and the return of an equilibrium state,

as can be seen in the illustration below, the shadows bottom may be long or

short or medium according to the size of the momentum Bearish provided by the sellers

of sizes Financial in the sale of currency because the lower long shadows indicate sizes selling

large ("high pushing of sale ") .

So now we

know the names of the four forms of Japanese candles, regardless of their

classification, let us remind you these names:

(1) Blue

Marubozu Candlestick

(2) Red

Marubozu Candlestick

(3)

Gravestone Doji

(4)

Dragonfly Doji

Hey Everybody,

ReplyDeleteI've attached a list of the highest ranking forex brokers:

1. Best Forex Broker

2. eToro - $50 minimum deposit.

Here is a list of top forex tools:

1. ForexTrendy - Recommended Odds Software.

2. EA Builder - Custom Strategies Autotrading.

3. Fast FX Profit - Secret Forex Strategy.

I hope you find these lists beneficial.