A couple of weeks ago I got a

private message from a community member, asking me to write something

specific to short-term traders, if possible. Taking the request into

consideration I'm going to describe a trading technique where trades

will last two days only, no more no less. If two days is already long

term for you, this system can be adapted to shorter time frames,

although the results will be poorer, so take that into consideration.

_________________________

► What is an inside day?

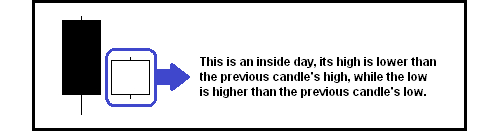

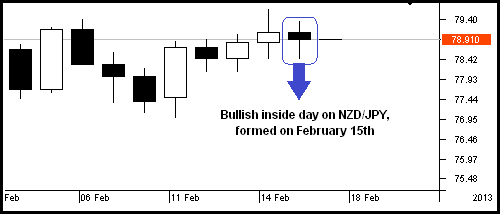

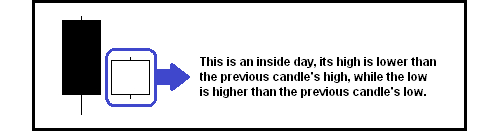

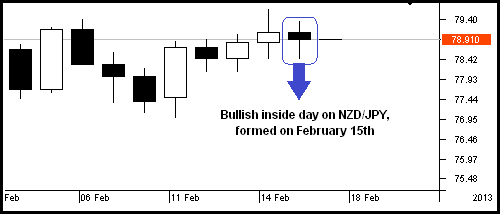

An inside day (also called inside bar/candle in intraday charts) occurs when the highest price is lower than the previous day's high, and the lowest price is higher than the preceding day's low. Here's a perfect example:

The common interpretation of inside days is that they are a sign of consolidation, where neither supply or demand are in control. It can also be considered a pause in a current trend, or the early signs of a counter trend movement. So, basically, it's a neutral candle that does not provide any positive trading edge. Well...not so fast, young Jedi! In trading, it helps to be a free-thinker and avoid subscribing to what the herds say. Try to look at your charts from a different perspective and you may end up noticing new and interesting patterns, which you can take advantage of.

_______________________________

► Description of this trading pattern

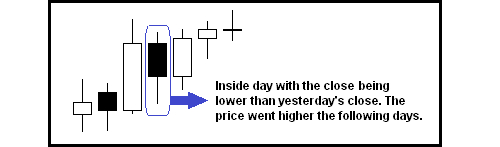

This setup is based on the observation that after an inside day the price shows a tendency to move in the opposite direction relative to the inside day's close. In simple words: when today's close is higher than yesterday's close (today being an inside day), then the market tends to go lower in the short term.

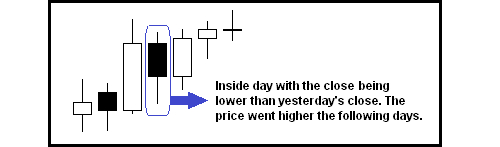

Vice-versa, when today's close is lower than yesterday's close, the price tends to move higher in the next few days.

Also, as with most strategies, the odds of success increase if you go with the trend, so I add a 50-day simple moving average (50 SMA) to the chart. This will be our trend filter. So, basically, with this strategy we enter trades when the price is retracing or pausing within a bigger trend.

________________________________________

► Trading Rules of the inside day pattern

You go LONG with a market order at today's close (00:00 GMT) when these conditions are met:

On the other hand, you go SHORT with a market order at today's close when:

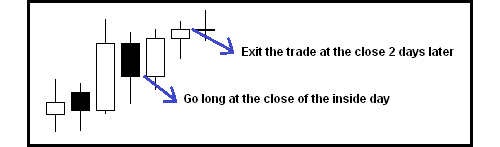

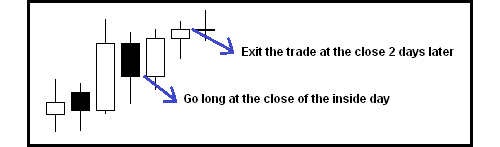

In both cases you exit the trade with a market order at the closing price two days after the entry, because, from what I've observed, that's when we can get the best risk/reward ratio out of this strategy. For example, if you open a trade at the close of the February 20th candle (Wednesday), you exit at the close of the February 22nd candle (Friday). No stop loss or take profit orders are used.

_____________________

► Backtesting results

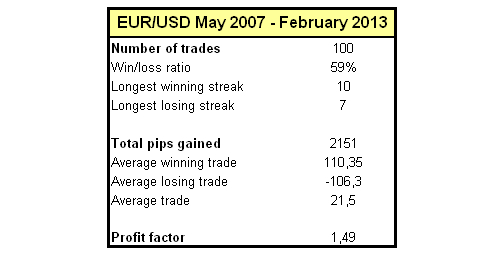

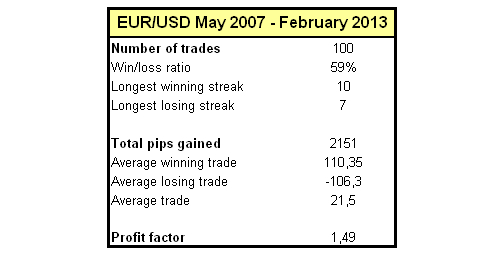

I manually backtested this strategy on EUR/USD since May 2007 (100 trades). While I do advise tests with more samples, 100 trades can give us a good idea if this pattern is profitable or not. For this test I assumed that spread + commissions = 1.5 pips per position. For the sake of simplicity only pips were taken in consideration.

The results confirm the initial analysis that there is an edge in trading in the opposite direction of an inside day's close, as long as the trade is in the direction of the longer term trend. Without the trend filter (50 SMA) the results would be less profitable.

_________________

► Final thoughts

As you have noticed, this is a very simple but profitable strategy, and can be further improved. I'm already thinking of new filters to add, which I may describe in an upcoming article. Due to the fact that it does not use a stop-loss (and negative trades can be -200, -300 pips) caution is advised when it comes to position sizing and leverage. Changing the size of your trades as the market volatility increases or diminishes (measured by ATR) is a simple way to reduce the volatility of your equity curve.

If trading daily candles is too boring for you because it does not generate many trades, diversification is the solution. Instead of trading just one currency pair, you can look for trades in, for example, 20 pairs (as uncorrelated as possible). That will multiply by 20 the number of trade signals the strategy generates. Don't forget to reduce your typical trading size by a factor of around 20 as well. This way your total exposure to the market and consequent profit potential remains the same, while the risk is much lower, because it is spread through 20 different positions.

Another aspect to take into consideration is that "officially" the new day in Forex starts at 17:00 NY time, currently 22:00 GMT, while on Dukascopy the daily candles are created at 00:00 GMT. I do not think that this has a big impact on the strategy, although to be honest I'd prefer candles to be created at 22:00 GMT.

Regarding shorter time frames, I have not tested the pattern in anything other than daily candles, and while it may be profitable using shorter time frames, the profit factor will most certainly be lower, due to random price noise and price spikes being more prevalent in intraday candles, not to mention the bigger importance the spreads and commissions have.

Score : http://www.dukascopy.com/fxcomm/fx-article-contest/?Simple-Easy-And-Profitable-Short&action=read&id=1220

_________________________

► What is an inside day?

An inside day (also called inside bar/candle in intraday charts) occurs when the highest price is lower than the previous day's high, and the lowest price is higher than the preceding day's low. Here's a perfect example:

The common interpretation of inside days is that they are a sign of consolidation, where neither supply or demand are in control. It can also be considered a pause in a current trend, or the early signs of a counter trend movement. So, basically, it's a neutral candle that does not provide any positive trading edge. Well...not so fast, young Jedi! In trading, it helps to be a free-thinker and avoid subscribing to what the herds say. Try to look at your charts from a different perspective and you may end up noticing new and interesting patterns, which you can take advantage of.

_______________________________

► Description of this trading pattern

This setup is based on the observation that after an inside day the price shows a tendency to move in the opposite direction relative to the inside day's close. In simple words: when today's close is higher than yesterday's close (today being an inside day), then the market tends to go lower in the short term.

Vice-versa, when today's close is lower than yesterday's close, the price tends to move higher in the next few days.

Also, as with most strategies, the odds of success increase if you go with the trend, so I add a 50-day simple moving average (50 SMA) to the chart. This will be our trend filter. So, basically, with this strategy we enter trades when the price is retracing or pausing within a bigger trend.

________________________________________

► Trading Rules of the inside day pattern

You go LONG with a market order at today's close (00:00 GMT) when these conditions are met:

- Today was an inside day (the whole candle fits within yesterday's daily range)

- Today's close is below yesterday's close

- Today's close is above the 50 SMA

On the other hand, you go SHORT with a market order at today's close when:

- Today was an inside day (the whole candle fits within yesterday's daily range)

- Today's close is above yesterday's close

- Today's close is below the 50 SMA

In both cases you exit the trade with a market order at the closing price two days after the entry, because, from what I've observed, that's when we can get the best risk/reward ratio out of this strategy. For example, if you open a trade at the close of the February 20th candle (Wednesday), you exit at the close of the February 22nd candle (Friday). No stop loss or take profit orders are used.

_____________________

► Backtesting results

I manually backtested this strategy on EUR/USD since May 2007 (100 trades). While I do advise tests with more samples, 100 trades can give us a good idea if this pattern is profitable or not. For this test I assumed that spread + commissions = 1.5 pips per position. For the sake of simplicity only pips were taken in consideration.

The results confirm the initial analysis that there is an edge in trading in the opposite direction of an inside day's close, as long as the trade is in the direction of the longer term trend. Without the trend filter (50 SMA) the results would be less profitable.

_________________

► Final thoughts

As you have noticed, this is a very simple but profitable strategy, and can be further improved. I'm already thinking of new filters to add, which I may describe in an upcoming article. Due to the fact that it does not use a stop-loss (and negative trades can be -200, -300 pips) caution is advised when it comes to position sizing and leverage. Changing the size of your trades as the market volatility increases or diminishes (measured by ATR) is a simple way to reduce the volatility of your equity curve.

If trading daily candles is too boring for you because it does not generate many trades, diversification is the solution. Instead of trading just one currency pair, you can look for trades in, for example, 20 pairs (as uncorrelated as possible). That will multiply by 20 the number of trade signals the strategy generates. Don't forget to reduce your typical trading size by a factor of around 20 as well. This way your total exposure to the market and consequent profit potential remains the same, while the risk is much lower, because it is spread through 20 different positions.

Another aspect to take into consideration is that "officially" the new day in Forex starts at 17:00 NY time, currently 22:00 GMT, while on Dukascopy the daily candles are created at 00:00 GMT. I do not think that this has a big impact on the strategy, although to be honest I'd prefer candles to be created at 22:00 GMT.

Regarding shorter time frames, I have not tested the pattern in anything other than daily candles, and while it may be profitable using shorter time frames, the profit factor will most certainly be lower, due to random price noise and price spikes being more prevalent in intraday candles, not to mention the bigger importance the spreads and commissions have.

Score : http://www.dukascopy.com/fxcomm/fx-article-contest/?Simple-Easy-And-Profitable-Short&action=read&id=1220

Hey Everyone,

ReplyDeleteBelow is a list of the highest ranking forex brokers:

1. Best Forex Broker

2. eToro - $50 minimum deposit.

Here is a list of the best forex instruments:

1. ForexTrendy - Recommended Probability Software.

2. EA Builder - Custom Indicators Autotrading.

3. Fast FX Profit - Secret Forex Strategy.

I hope you find these lists beneficial...